Happy Wednesday, everyone, and welcome to this mid-week edition of Where’s the Freight?,” Trucker Tools’ free freight market report for owner operators and carriers. “Where’s the Freight?” provides you with projections and insights into where demand and rates will be highest and lowest across North America in the coming week.

According to a report released yesterday, U.S. retail sales increased in October for a third consecutive month, indicating that consumer spending hasn’t slowed despite the fact that U.S. prices are rising at their fastest pace in 30 years. Some contend that retail sales are higher than usual because consumers are attempting to beat shipping delays by doing their holiday shopping earlier than in previous years.

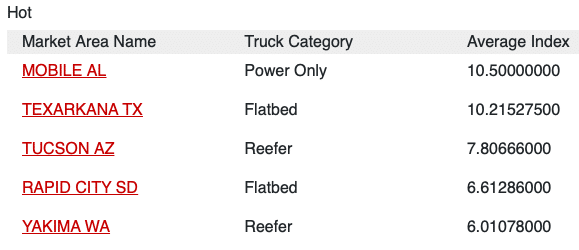

In this Wednesday edition of “Where’s the Freight?,” you’ll notice that our Top Five Hottest Markets list is evenly split between power only, flatbed and reefer markets, reflecting sustained demand across all three sectors. For the first time ever, the Mobile, Ala., power only market claims the top spot in our top five list, making it the most profitable market for truckers and carriers in the coming week. Also of note in today’s freight forecast — flatbed demand will remain elevated in two key Texas markets, while Tucson, Ariz., is projected to be the highest demand/rate reefer market over the next five to seven day period.

To get all the details on what to expect from freight markets across North America this week, scroll down to read the rest of this mid-week edition of Trucker Tools’ “Where’s the Freight?”

Where Demand and Rates Are Likely To Be High or Rising

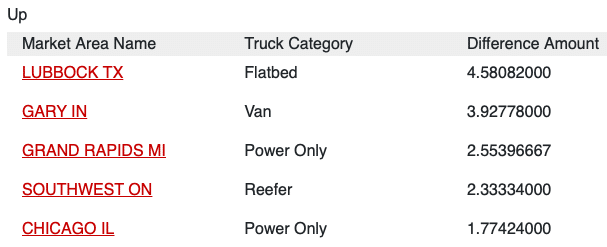

- Texarkana, Texas, and Rapid City, S.D., will be the highest demand (and rate) flatbed markets across the United States and Canada over the next five to seven days. Look for flatbed demand to increase in the coming week for Lubbock, Texas.

- This week, reefer demand to/from Tucson, Ariz., and Yakima, Wash., will be high. You also can expect reefer demand to/from Southwestern Ontario to rise.

- Over the next five to seven days, Mobile, Ala., is projected to be the highest demand and highest rate power only market in North America. Power only demand is expected to increase in the coming week for Grand Rapids, Mich., and Chicago.

- Dry van demand likely will increase this week for Gary, Ind.

Where Demand and Rates Are Likely To Be Low or Falling

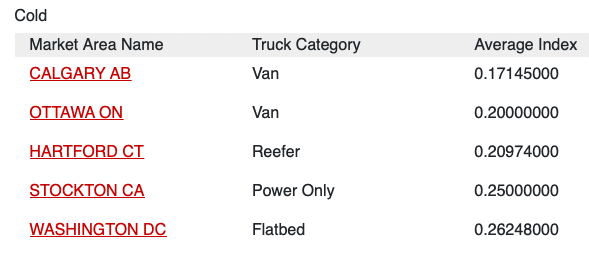

- Washington D.C. will be the lowest demand and lowest rate flatbed market this week.

- Hartford, Conn., will continue to be a cold spot for reefer capacity over the next five to seven days. Reefer demand to/from Edmonton, Alberta, is projected to decline this week.

- In the coming week, demand and rates for power only capacity to/from Stockton, Calif., is likely to be extremely low. Look for power only demand to decrease this week for Springfield, Mass.

- You can expect low demand and rates for dry van capacity to/from Calgary, Alberta, and Ottawa, Ontario, in the coming week.

Trucker Tools’ Market Insights

- Based on the very latest Trucker Tools data, the five most profitable markets for truckers and carriers in the coming week will be: 1. Mobile, Ala. (power only), 2. Texarkana, Texas (flatbed), 3. Tucson, Ariz. (reefer), 4. Rapid City, S.D. (flatbed), and 5. Yakima, Wash. (reefer).

- This week, the five least profitable markets for truckers and carriers will be: 1. Calgary, Alberta (dry van), 2. Ottawa, Ontario (dry van), 3. Hartford, Conn. (reefer), 4. Stockton, Calif. (power only), and 5. Washington D.C. (flatbed).

- The latest Daily Market Update from FreightWaves finds that national outbound tender rejections are up and national outbound volumes are down.

- Demand for power only capacity to/from Mobile, Ala., this week will be 10 times higher than it was during the same time period in 2020.

- Today’s U.S.D.A. Specialty Crops National Truck Rate Report indicates produce capacity shortages in the following areas: Mexico Crossings through Nogales, Ariz., San Luis Valley Colorado, West District Florida, Idaho and Malheur County Oregon, Upper Valley and Twin Falls-Burley District Idaho, Minnesota-North Dakota (Red River Valley), New York, Eastern North Carolina, Columbia Basin Washington state, Yakima Valley and Wenatchee District Washington state, and Central Wisconsin.

- In the coming week, the Gary, Ind., dry van market is projected to favor owner operators and carriers by more than two to one, which means there will be at least two loads available for every dry van trailer headed into the region.

For more insights into where demand/rates will be high and low, read Where’s the Freight? Texarkana, Edmonton, Rapid City, Mobile and Lubbock Highest Demand/Rate Markets This Week.

To download the Trucker Tools app, visit https://www.truckertools.com/carriers/. To start using Trucker Tools’ free carrier software platform, visit https://bookaload.truckertools.com/.